Foreign loans that use minerals as collateral may complicate Zimbabwe’s future negotiations with foreign creditors to restructure its $8.8 billion debt, an International Monetary Fund official said.

Gene Leon, the IMF mission chief to Zimbabwe said in Harare that Zimbabwe remained in debt distress.

Leon said the distress was due to its $2.6 billion arrears to the World Bank, African Development Bank and European Investment Bank and this could prevent access to new funds from multilateral lenders.

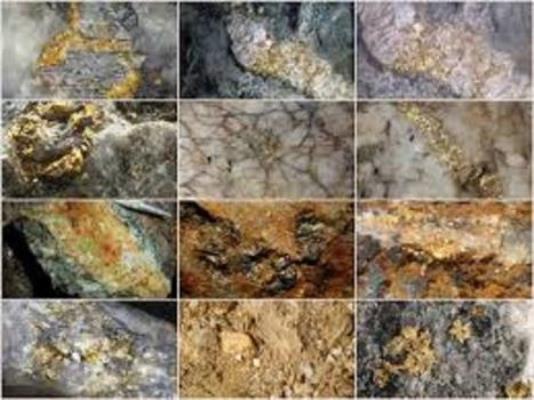

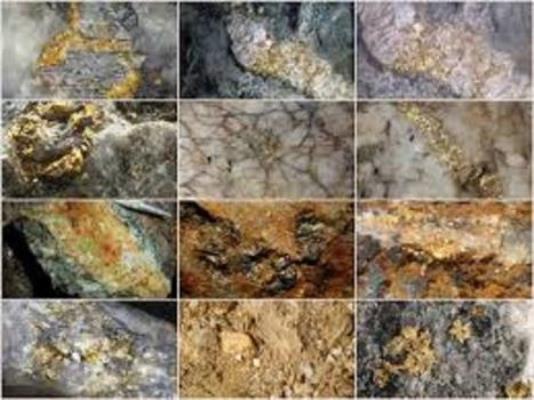

Unable to get funding from lenders like the IMF since defaulting on its debt in 1999, Zimbabwe has over the last five years relied on the African Export and Import Bank (Afreximbank) for mineral-backed loans.

The country still faces a dollar crunch that has led to shortages of fuel and medicines.

“In this context, the government has contracted external loans on commercial terms that are collateralized by mineral exports,” Leon said in emailed responses to Reuters.

“While these loans can help the authorities in responding to the economic and humanitarian crisis that is unfolding, they may also complicate future negotiations with external creditors to restore debt sustainability.”

Leon said Zimbabwe’s projections of economic growth would probably be revised in the short term because of drought and a cyclone that battered the eastern regions.

The IMF forecasts the economy will shrink by 2.1 per cent this year.

President Emmerson Mnangagwa, who came to power after a coup toppled Robert Mugabe in November 2017, has made clearing foreign arrears a top priority.

His government has agreed an IMF staff programme it hopes will help pay off multilateral lenders and Paris Club creditors next year.

The central bank, which has previously said it borrowed $985 million from African lenders last year, said on May 19 it had secured $500 million from unnamed international banks.

Treasury officials said the money was from Afreximbank.

That loan included $100 million bridging finance in February, two treasury sources said, adding that some of the money was used to buy fuel and make “token” payments to South Africa and Mozambique for past electricity imports.

Gene told Reuters that implementing fiscal and monetary policy reforms, including the removal of exchange restrictions to stabilise the exchange rate and inflation, would be hard without external funding and after a severe drought.

At 75.86 per cent in April, Zimbabwe’s inflation is still nowhere near the 500 billion per cent reached during the hyperinflation era of 2008.

But the consumer price index is at its highest in a decade and eroding incomes and savings.

Zimbabwe increased the price of fuel by nearly half last month, the second increase since January, angering citizens battling with soaring prices of basic goods.

As inflation soars, the new RTGS dollar that was introduced in February continues to weaken.

The currency was trading at 8 to the dollar on the black market compared with 5.52 on the official interbank market.

The local currency has now depreciated by 91 per cent on the black market and 121 per cent on the official market since its introduction.