Tanko Mohammed

Nigeria has resolved to borrow $15.5 billion from domestic and foreign sources, stop subsidies on petroleum products and electricity to be able to implement its 2021 budget of $37.7 billion.

The budget is running at a deficit of $15.5 billion, being mainly a negative fallout from glut in global crude oil, the main revenue earner to the country in the last four decades.

In aggregate, 30 percent of projected revenues will come from oil-related sources while 70 percent is to be earned from non-oil sources but the size of the budget has been constrained by low revenues.

Borrowing

The government has therefore resolved to raise money from domestic and foreign sources as well as multi-lateral and bi-lateral loan drawdowns.

The resort to loans would increase the current national domestic and foreign debt of $85 billion as confirmed by the Debt Management Office (DMO).

According to a statement issued by DMO, the amount represents the total debt stock of the Federal government, 36 states of the federation and the Federal capital Territory.

DMO said the increase in the Debt Stock $6.593 billion in 2020 was accounted for by the budget Support loan from the International Monetary Fund, New Domestic Borrowing to finance the Revised 2020 Appropriation Act including the issuance of Sukuk.

DMO expects “the public debt stock to grow as the balance of the new domestic borrowing is raised and expected disbursements are made by the World Bank, African Development Bank and the Islamic Development Bank which were arranged to finance the 2020 Budget.”

Unclaimed dividends and dormant bank accounts

Finance and National planning minister Zainab Ahmed, reported plans to rake in money from all available sources, including $2.3 billion from unclaimed dividends in the stock market and dormant bank deposits, a decision already creating ripples within the circle of opposition and rights groups.

The government said it would keep the money mopped up from unclaimed dividends in a trust fund for the beneficiaries, ignoring calls by opposition and rights group, who have kicked against tinkering with such monies.

“At any time, a registrar or a bank confirms a true and bona-fide beneficiary of this fund, then government will release money into the trust fund to pay the investor,” the finance minister explained.

The Central Bank of Nigeria (CBN) and the Registrars of Security Firms, she explained have been given the mandate to ascertain how to raises fund from unclaimed dividends and dormant accounts.

Privatisation

She said government would also raise $570 million from proceeds of the privatisation of some identified state’s assets.

The privatisation of key assets have been on for decades, a policy designed to cut cost of governance, especially the sale of non-performing government’s companies, including telecommunication firms and steel companies.

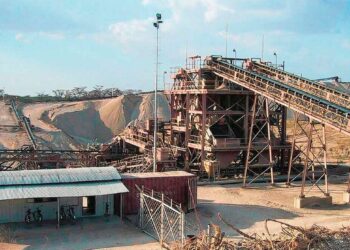

The federal government is eyeing the privatisation of some firms in the oil and gas sector this year, especially the moribund petroleum refineries.

Tax Waivers

The government is also assessing existing tax waivers granted to some organisations and companies to ascertain the level of burden on government.

She said: “What it’s costing us, we are now in the process of reviewing what can be scaled back because the size of the cost of the tax waiver is quite significant in terms of revenue for the country.’’

The government’s Finance Act of 2020 reviewed and amended several taxes, granting waivers to encourage certain categories of companies.

Sector-specific Incentives are given mainly to target a particular industry with the aim of encouraging investment in such industry; these include the oil and gas, agriculture, power, manufacturing, and telecommunications sectors.

The Federal Inland Revenue Service (FIRS) had indicated that all concessions for waivers of penalty and interest on outstanding tax liabilities will come to an end by 31 December 2020.

This implies that any unresolved or unpaid tax liabilities arising from tax audits and other reviews by the FIRS will attract applicable penalties and interest from January 2020.

Removal of Subsidies

Ahmed said government was not going to bring back fuel subsidy, “we didn’t make provision for fuel subsidy in the budget’’.

She also stated that the government did not make any provision for electricity subsidy in 2021 and would not subsidise power.

“We are not bringing back fuel subsidy. We didn’t make provision for fuel subsidy in the budget. The impact of what was done was reducing some of the cost components that were within the template.

“And also related to it, on matters of electricity subsidies, no provisions have been made for subsidy for fuel and no provisions have been made for subsidy for electricity.”

The removal of subsidies is already being felts by consumers of electricity and petrol.

The Nigeria Labour Congress (NLC) has engaged the federal government to put human face in the policy as it could make life more difficult in the era of downturn caused by the negative impact of coronavirus pandemic.