Futureview Asset Management has offered investment tips for building an efficient portfolio due to speculative higher inflationary pressure following the Federal Government’s retention of petroleum products subsidy.

The Managing Director, Futureview, Mrs Ughochi Nnodi, said in a statement released on Thursday in Lagos.

Nnodi said that after eight months of steady deceleration in headline inflation, there was a marginal spike in the December 2021 rate from 15.4 per cent in November 2021 to 15.63 per cent in Dec. 2021.

She said the current increase in headlines inflation attributed to currency depreciation and the liquidity challenges in the foreign exchange market would impact negatively on all investment outlets.

Nnodi explained that investors could optimise the tough operating environment by investing in assets that hedge against inflation.

According to her, there are resilient sectors that outperform inflation and generate alpha returns.

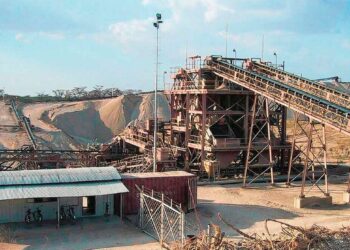

She noted that investors should take advantage of sectors such as commodities, financials, healthcare, consumer staples, energy, technology and real estate to build a balanced portfolio.

“There are resilient stocks that thrive during inflation because of their underlying assets.

“Investors should build their portfolios with stocks of companies in the healthcare, energy, commodities, consumer staples, financials and real estate, among others as a risk and reward trade off.

“We should not lose sight of mutual funds which is a collection of investment in different asset classes.

“At Futureview, we design financial products to meet the demand of our array of customers with diverse investment objectives and risk tolerance.

“For instance, we have a product that targets Nigerians in the Diaspora. It is called Futureview Dollar Fund. We floated it along with Futureview Equity Fund. The two financial instruments hedge investment against inflation while they provide regular income.

“It is settled in portfolio management that during high inflation rate, mutual funds provide an opportunities for diversification at every dollar level, sharing of investment expenses, economies of scale and operational efficiencies,” said Nnodi.