The Lagos Chamber of Commerce and Industry (LCCI) and major Nigerian solid minerals sector stakeholders have proffered solutions aimed at driving potential investments and harnessing benefits across the mining value chain.

They made their recommendations in a communique signed by the Head, Corporate Communications, LCCI, Mr Sunday Osanyintuyi, on Monday in Lagos.

Dr Michael Olawale-Cole, President, LCCI, stated that the recommendations were to generate insights that would position Nigeria to earn more foreign exchange from solid minerals.

He added that the recommendations were prompted from a review by the LCCI alongside the Association of Metal Exporters of Nigeria (AMEN) and Soundcore Group (SG).

Olawale-Cole said a report by the Nigerian Extractive Industries Transparency Initiative (NEITI) indicated that revenue from the sector to the Federation Account rose by 54 per cent in 2020 to N128 billion compared to N75 billion recorded in 2019.

He added that trade statistics from the National Bureau of Statistics (NBS) showed that the value of total trade in solid minerals in Q4, 2021 stood at N43.37 billion, representing 0.37 per cent of total trade in Q4, 2021.

“Solid minerals exports in Q4, 2021 stood at N13.56 billion, a decrease of 25.95 per cent compared to Q3, 2021 but an increase of 201.41 per cent when compared to the corresponding quarter of 2020.

“These are confirmations about the potentials in the solid minerals sector yet untapped,” he said.

The LCCI President said that the highlights from the Organised Private Sector (OPS) revealed that the fragmented legislative framework of the 1999 constitution hindered investment in the solid minerals sector.

According to him, the constitution, as amended, gives the Federal Government of Nigeria, exclusive powers to legislate on mining and solid mineral matters.

He, however, noted that several state governments had enacted parallel mining laws and regulations, which continued to interfere and usurp government’s powers and the statutory powers of the mines and steel development ministry to regulate activities in the sector.

“Presently, Nigeria only attracted about 0.12 per cent of global exploration investments.

“The emerging market for Nigeria’s solid minerals includes industrialized and urban development like BRICS & G20 countries which created a demand for energy, metals, and minerals.

“However, instability laws and regulations of solid minerals exploration give a bad signal to investors as the risk of resource nationalism after the investment decisions have been made scare existing and potential investors in solid minerals exploration,” he said.

Olawale-Cole stressed the need to establish a robust fiscal framework for investors and address the bottlenecks due to the multi-agencies regulatory structure in the sector.

He also called on government to tackle security challenges across mineral-rich communities in the Northern region and other mining communities which continued to undermine production and investment.

“There’s need to invest in refineries for minerals as we cannot continue to mine minerals and export them in their primary state or else Nigeria might remain a crude exporter of minerals, which is analogous to challenges in the oil sector.

“The government and private investors should secure the communities’ buy-in in the project in the spirit of environmental justice, economic empowerment, and social harmony, which is critical in preventing and replicating the flaws witnessed in the Niger Delta.

“Steel production should be encouraged because mining and metal production could be used to develop infrastructure and reduce import dependence.

“Nigeria must develop mineral commodities markets and dependent instruments to trigger innovation through technology, material science, biotechnology, and supercomputing alloy.

“We must also have separate drilling strategy for grassroots/early exploration (identify targets) and separate drilling strategy for advanced exploration (define a deposit),” he said.

The Minister of Mines and Steel Development, Arc. Olamilekan Adegbite, stated that a sustainable and well-governed mining sector with good investment inflows was key to a diversified economy beyond oil in the present economic environment.

Adegbite noted that the sector would have developed more than its present position, but was marred by low financial intermediation.

He urged the financial industry to venture into the investment opportunities in the mining sector, to impact the nation’s economy positively.

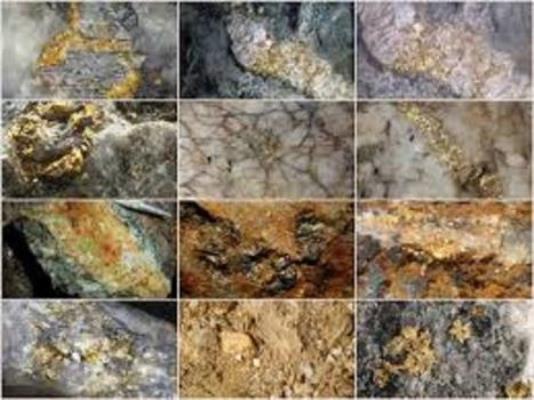

He said that National Integrated Mineral Exploration Programme (NIMEP), an initiative of the government to provide reliable geo-data for investment decision-making had further exposed investment opportunities in gold, lead, zinc, battery minerals, barite, and iron ore.

He added that NIMEP short-term initiative was to auction the results from existing exploration and plough back the fund into the development of unexplored minerals.

The Minister, however noted that the more sustainable approach was financial intermediation and Foreign Direct Investment (FDI) inflow into the mining sector.

“The success of rebuilding the industry to achieve the transformational ambition for shared mining prosperity depends on the participation of all stakeholders, including a vibrant financing industry.

“The Nigerian banking system has limited exposure to mining and this probably is due to a lack of sufficient understanding of the opportunities in mining or the complex nature of the sector.

“According to NIMEP, solid minerals are capital intensive, and this is evident

when a 50 million dollar investment was used in executing four (4) out of the forty-four (44) minerals discovered as exploration in Nigeria.

“The ministry would embark on a transformational reform agenda aimed at providing good practice in mineral resource management,” he said.