Dangote Industries Limited (DIL) has announced the successful completion of the company’s N187.6 billion series 1 bond issuance which is the largest corporate bond ever issued in the history of the Nigerian capital market.

The company made the disclosure in a statement signed by Mr Francis Awowole-Browne, Media and Communication Personnel, DIL, on Tuesday in Lagos.

The landmark transaction comprises of a seven year Tranche-A bond issued at 12.75 per cent and a 10-year Tranche-B bond issued at 13.50 per cent, under the newly established N300 billion debt issuance programme.

According to the statement, the bond issuance was well received by the capital market with wide participation from investors including domestic pension funds, asset managers, insurance companies and high net-worth investors.

It added that the company planned to utilise the net proceeds from the Series 1 bond issuance to part-finance the Dangote Petroleum Refinery Project, an integrated petrochemical complex, and the largest single train petroleum refinery in the world.

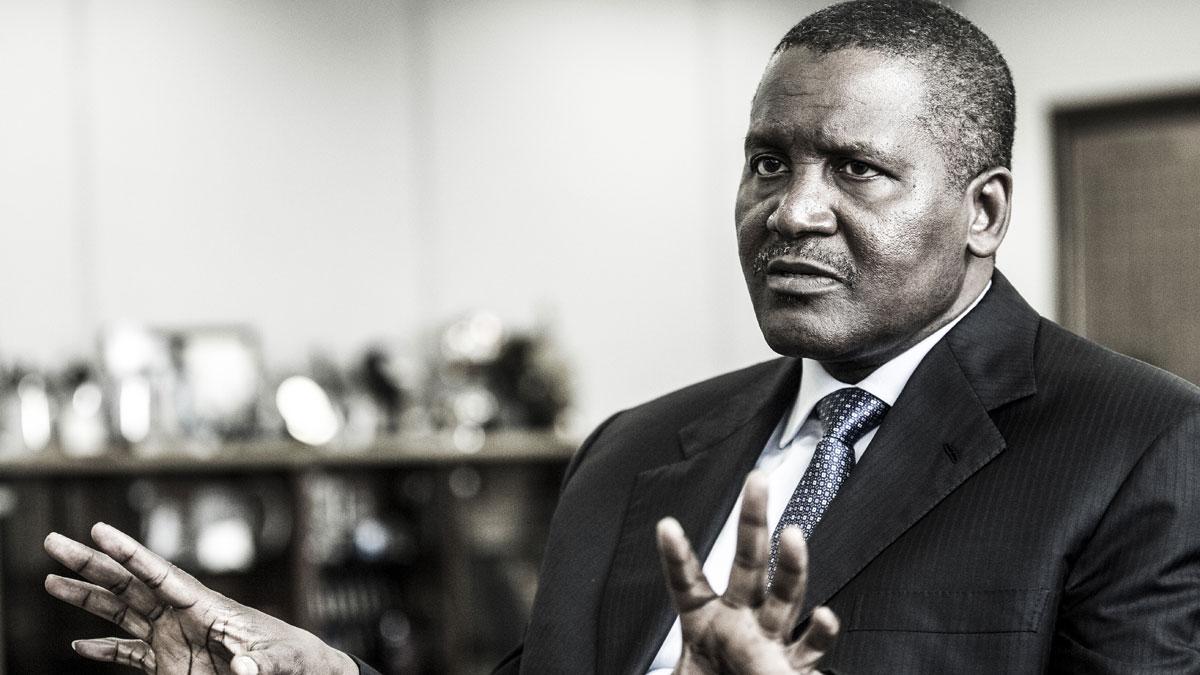

Commenting on the significance of the transaction, Mr Olakunle Alake, Group Managing Director, DIL, expressed delight at the company’s ability to successfully conduct the transaction.

Alake said that the success of the transaction further demonstrates investor confidence in the company’s credit story and the appreciation of the work done by the Group across several key sectors crucial to the development of the continent.

“We are very pleased to have set this remarkable milestone, showcasing the depth and liquidity of the Nigeria Debt Capital Market.

“The proceeds from this landmark transaction will be used to part-finance the Dangote Petroleum Refinery Project which is the initiative by the company to establish the largest refinery in Africa, thus positioning Nigeria as a net exporter of refined crude.

“We want to specially thank the investor community for their support on this transaction, as well as our various advisors and stakeholders,” he said.

Mr Olukorede Adenowo, Standard Chartered’s Executive Director, Corporate, Commercial and Institutional Banking, Nigeria and West Africa, expressed pride on behalf of the issuing houses, to have led the historic transaction.

Adenowo said the development reflected the strong credit quality of the issuer as well as the resilience of the Nigerian domestic debt capital markets, in spite of the current global market volatility.

“We thank the board and management of Dangote Group for continuously striving to develop the domestic debt capital markets and setting records through its various issuances both at the subsidiary and group levels.

“We also thank the Securities & Exchange Commission, Nigerian Exchange Limited (“NGX”) and FMDQ Securities Exchange Limited (“FMDQ”) for their unwavering support throughout this entire process.

“The Bond notes will be listed on the NGX and FMDQ,” he said.

NAN also reports that Standard Chartered Capital and Advisory Nigeria Limited acted as the lead issuing house and bookrunner on the transaction.

Meristem Capital, Stanbic IBTC Capital, Vetiva Capital, Absa Capital Markets, Afrinvest Capital, Coronation Merchant Bank, Ecobank Development Company, FBNQuest Merchant Bank, FCMB Capital Markets, Greenwich Merchant Bank, Quantum Zenith Capital, Rand Merchant Bank Nigeria and United Capital acted as joint issuing houses.