The Pension Fund Operators Association of Nigeria (PenOp) on Tuesday lauded the National Pension Commission (PenCom) for releasing guidelines to access equity for residential mortgage.

A statement made available by PenOp’s spokesperson, Ms Olajumoke Akinwa, in Lagos described the policy as positive for the pension industry and the economy as a whole.

PenCom had on Sept. 23 approved the implementation of the guidelines for Retirement Savings Accounts (RSA) holders to access 25 per cent of their balance for payment of equity contribution for residential mortgage.

The commission said the approval was in line with Section 89 (2) of the Pension Reform Act 2014 (PRA 2014), which allowed RSA holders to use a portion of their RSA balance towards payment of equity for residential mortgage.

PenCom noted that the guidelines covered pension contributors in active employment, either as salaried employees or as self-employed persons.

According to the commission, the RSA of the applicant shall have mandatory contributions for a cumulative minimum period of five years.

PenOp said the policy was catalytic in nature and had the potential to spur growth in other sectors of the economy.

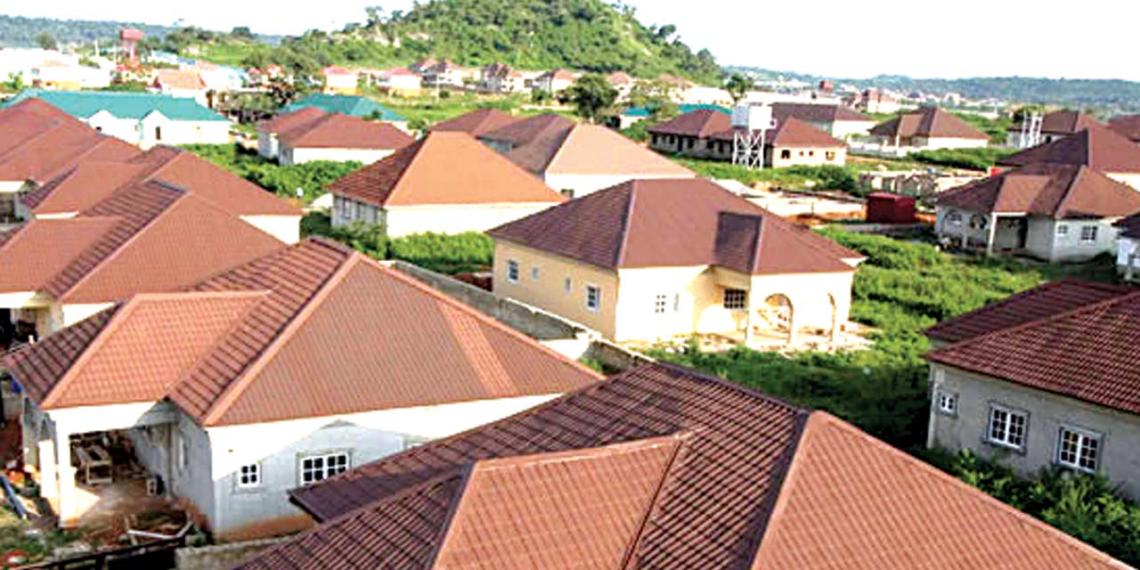

The pension operators stated that the guidelines would boost the mortgage finance and home loan sector, in addition to having a positive effect on the construction value chain and building materials sector.

“We are aware that the process of actualising this portion of the Act has gone through a number of iterations and stakeholders engagement and we are happy that it has finally been released.

“Whilst we realise that there might be some initial teething problems, we are excited and are primmed to partner with the commission, RSA holders and other stakeholders to ensure that this policy actualises the reason why it was set up,” the operators said.

According to the association, home ownership ratio and first-time home buyer statistics in Nigeria is very low and as such, this policy will help to improve this and also provide increased benefits to RSA holders.

PenOp expressed optimism that the policy would create massive jobs for artisans and blue collar workers involved in the construction value chain.

The pension operators said the opportunity would open up the wealth management and financial planning industry, as RSA holders would begin to plan towards a target RSA balance because of the goal of owning a home.

“We also believe that voluntary contributions will increase because people can use the contingent portion of their voluntary contributions as part of the equity contribution for residential mortgages.

“In addition, more companies will now take their contributions more seriously, as well as staff of these companies.

“We believe this will help to grow the micro pension business and ensure that millions of Nigerians in the informal sector have the opportunity to enjoy structured pensions when they retire and also benefit from the gains of the pension reform,” it said.