The executive board of the International Monetary Fund (IMF) has approved a Ksh55.1 billion ($447.39 million) loan to Kenya, paving way for the immediate release of the funds to the exchequer for budgetary support.

This follows the fourth review of the $2.34 billion (Ksh288 billion) 38-month Extended Credit Facility (ECF) and the Extended Fund Facility (EFF) arrangements with Kenya.

This brings Kenya’s cumulative disbursements under the EFF/ECF arrangements to about $1.655 billion (Ksh203.84 billion)

The loan, which was approved in April 2021, aims to support Kenya’s programme to address debt vulnerabilities, the response to the Covid-19 pandemic and global shocks, and to enhance governance and broader economic reforms.

The IMF noted that Kenya’s economy remains stable and projects it to grow by 5.3 per cent this year despite a challenging global environment but warned that climate-related risks are elevated in the medium-term.

The global lender said the current account deficit is set to widen further despite the double digit growth in exports due to higher global crude oil prices.

The IMF said public debt has started to level off due to fiscal consolidation efforts by the government but warned that obligations carried over from the last financial year and an increase in unbudgeted spending in early 2022/23 fiscal year increased pressures on the budget.

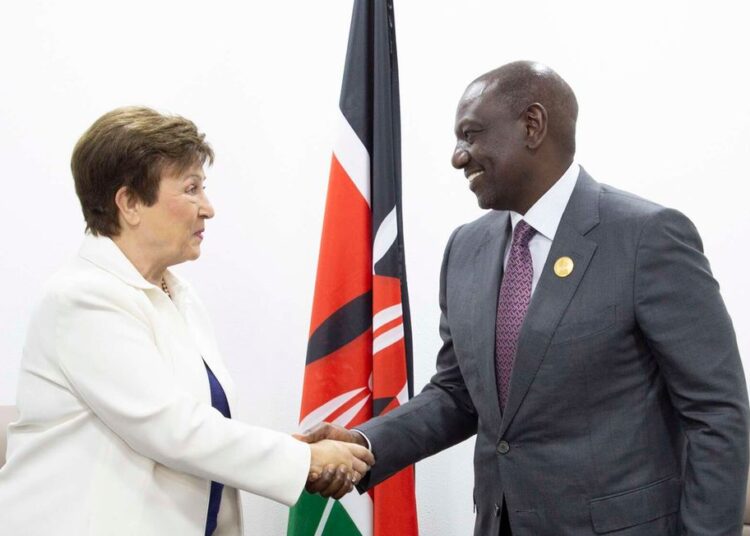

But the lender noted that the new administration of President William Ruto has reasserted Kenya’s commitment to fiscal consolidation, targeting a lower overall fiscal deficit than the original budget.

Dr Ruto, in his inaugural speech to Parliament in September, announced a cut of Ksh300 billion ($2.4 billion) to this year’s Ksh3.3 trillion ($26.8 billion) budget to ease pressure on the exchequer.

The loan will help buffer Kenya’s foreign exchange reserves which had fallen to just 3.98 months of import cover below the legal threshold of four months.

“Kenya’s commitment to its economic programme supported by the Fund’s EFF and the ECF arrangements is anchoring debt sustainability. The economy has performed well amid slowing global growth, tighter financing conditions and volatile commodity prices, while the continuing drought has increased food insecurity, and climate-related risks pose ongoing challenges.

Mutually reinforcing prudent macroeconomic policies and resolute implementation of structural reforms remain essential to safeguard positive medium-term prospects,” said Antoinette Sayeh, the IMF deputy managing director.

She said that strong performance of tax revenues has supported resilience and cushioned the initial impact of global shocks on households and businesses, and lauded the gradual withdrawal of fuel subsidies by Dr Ruto’s administration as well as plans for re-prioritisation of expenditure to cut the fiscal deficit.

“Looking ahead, continued strong commitment to fiscal consolidation over the medium term remains key to reduce debt vulnerabilities. Additional tax policy measures, anchored in a medium-term revenue strategy to secure space for needed social and development spending, and improved spending efficiency, revenue administration, and public financial and debt management will be key,” said Ms Sayeh.

The lender also welcomed the move by the Central Bank of Kenya (CBK) to raise the base lending rate for the second time in a row to ease inflation arguing that “further tightening would limit second-round effects and keep inflationary expectations well-anchored while supporting external adjustment”.

The IMF further said that addressing vulnerabilities at Kenya Airways and Kenya Power is urgent, along with strengthening the governance framework for state-owned corporations.

“Alongside new initiatives to promote inclusive growth, progress on the structural reform agenda should continue.

By beginning to publish beneficial ownership information for successful bidders of new procurements, Kenya delivers on a key commitment to enhance transparency and accountability,” said Ms Sayeh.

East AFrican