The Centre for the Promotion of Private Enterprise (CPPE) has welcomed the restraining order of the Supreme Court on the timeline for the naira swap.

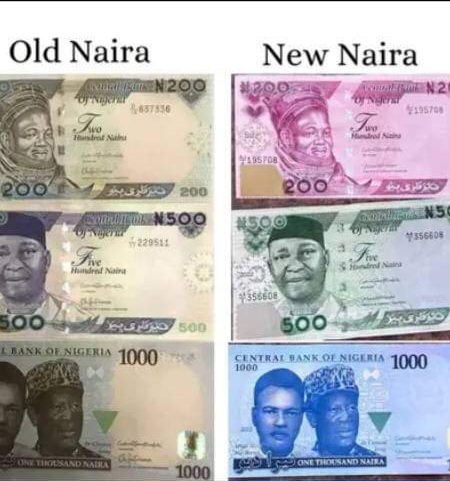

The Supreme Court had halted the Central Bank of Nigeria (CBN) from implementing the Feb. 10 deadline for the validity of old notes as legal tender.

According to Dr Muda Yusuf, Founder, CPPE, the action of the Supreme Court would restore normalcy to economic activities, especially in the distributive and informal trade sector as well as rural economy.

Yusuf added that the development would also douse the current social tension and the risk of social unrest in the country.

He noted that small businesses and the ordinary citizens were the biggest victims of the unspeakable disruption and hardship inflicted by the deadline given by the CBN on naira swap.

He reiterated that the CBN naira swap model and timeline was flawed given the country’s huge population of over 200 million, large informal sector and rural economy and over 30 million unbanked citizens.

“It is inappropriate to arbitrarily cut down on currency in circulation without due regard to data, empirical studies and global best practices.

“In Nigeria, cash to Gross Domestic Product (GDP) ratio is less than 1.5 per cent; while cash/money supply ratio is just about 5 per cent.

“This underlines the fact that cash is not the problem of the Nigerian economy or monetary policy effectiveness.

“We affirm our position that N2.6 trillion currency in circulation is not too much for the Nigerian economy with a GDP of about N250 trillion.

“Any attempt to arbitrarily cut it will create a crisis,” he said.

Yusuf said it was unacceptable that citizens were denied access to their cash deposited for purposes of naira swap.

This, he stressed, could undermine the confidence of the citizens in the banking system and pose a major risk to the financial inclusion objective of the CBN.

He furthered stated that on boarding citizens unto the cashless platform should not be decreed or forced on them but should be voluntary and incentive driven.

“Meanwhile, in compliance with the supreme court order, we urge the CBN to immediately allow the old and new currency notes to co-circulate until such a time when the old notes are gradually and completely withdrawn.

“This is global best practice and this should happen within a space of three to six months.

“Meanwhile, all the cash that has been mopped up should be released to their owners, unless there are reasons to suspect such lodgement and this should be escalated to the anti-graft agencies.

“Citizens that have lodged their cash for purposes of the cash swap should be allowed unfettered access to their money,” he said.