The World Bank Group (WBG) and the International Monetary Fund (IMF) between April 10 and April 16 converged on Washington DC for their Annual Spring meetings.

The meetings brought together central banks, international financial institutions, ministers of finance and development, private sector executives, representatives from civil society organisations, and academics to discuss global economy issues.

It held amidst international efforts to stimulate global economy dampened by post-COVID-19 crisis, the Russia-Ukraine conflict, food shortages and climate-related challenges.

The meeting focused on agriculture and food insecurity, economic recovery, increasing fragility, conflict, and violence, climate change and debt, empowering women entrepreneurs, and the importance of private capital in sustainable development, among others.

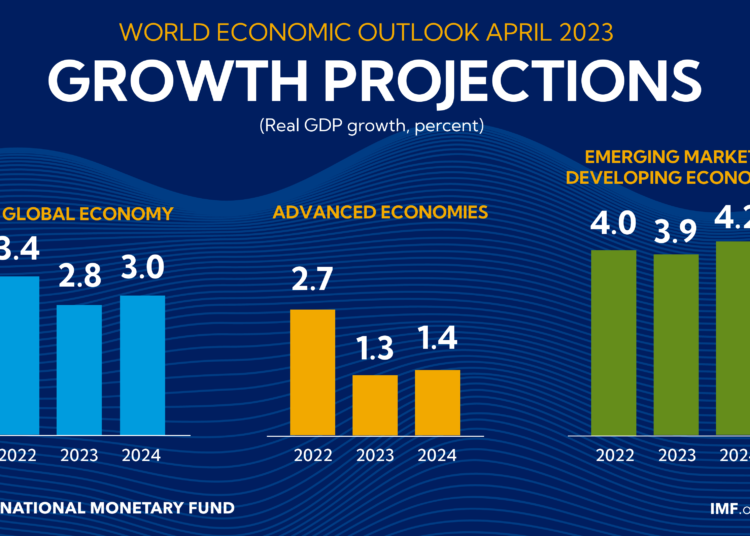

The IMF’s latest World Economic Outlook Update Report for April 2023: “A Rocky Recovery”, released at the meetings shows global growth is projected to bottom out at 2.8 per cent in 2023 before rising modestly to 3.0 per cent in 2024.

The report showed that advanced economies were expected to see a growth slowdown from 2.7 per cent in 2022 to 1.3 per cent in 2023.

While the outlook growth in Sub-Saharan Africa (SSA) is expected to slow to 3.6 per cent in 2023 as a “big funding squeeze”, tied to the drying up of aid and access to private finance, hits the region.

The report said the slowdown and subsequent rebound to 4.2 per cent in 2024 in SSA was in line with global recovery, subsiding inflation, and a winding down in monetary policy tightening.

According to the report, this will be the second consecutive year that SSA will record a lower rate of growth than the previous year.

Abebe Selassie, Director, African Department, IMF, while speaking at the new conference on the SSA Regional Economic Outlook during the meetings, said some countries, particularly those in the East African Community bloc, or non-oil resource-intensive countries, were expected to fare better.

He said Nigeria’s economy, a major oil exporter in Africa, was expected to grow by 3.2 per cent in 2023, down from 3.6 per cent in 2022, and projected growth to slow to 3.0 in 2024.

“The rapid tightening of global monetary policy has raised borrowing costs for SSA countries both on domestic and international markets.

“All Sub-Saharan African frontier markets have been cut off from market access since Spring 2022″, he said.

Selassie said the US dollar effective exchange rate reached a 20-year high last year, increasing the burden of dollar-denominated debt service payments.

He also said if measures were not taken, the” funding squeeze” will hamper Sub-Saharan’s efforts to build a skilled and educated population and to be the driving force of the global economy in years to come.

“First, it is important to consolidate public finances and strengthen public financial management amid difficult funding conditions.

“Second is containing inflation. Monetary policy should be steered cautiously until inflation is firmly on a downward trajectory and projected to return to the central bank’s target range.

“Third is allowing the exchange rate to adjust, while mitigating the adverse effects on the economy, including the rise in inflation and debt due to currency depreciations”, he said.

World Economic Outlook, April 2023: A Rocky Recovery

World Economic Outlook April 2023. Source: International Monetary Fund.

Mr David Malpass, World Bank Group President, said the diversion of natural gas to Europe presented grave obstacles to developing countries’ production of electricity, fertilizer, and food.

“These problems are severely constraining future growth and deepening inequality and fragility for developing countries.

“I travelled to West Africa in March, where we are working to provide support in the face of these problems”, he said.

Malpsss, during a news conference in the course of the meetings called on the incoming government in Nigeria to tackle trade protection that blocks importation; address dual exchange rates; and diversify the economy to achieve shared prosperity and sustainable growth.

The Bank’s President said in the Group’s forecast, Nigeria’s growth was 3.3 per cent in 2022 and 2.8 per cent in 2023.

Malpass went on to advise policymakers in Nigeria and other SSA countries to focus on policies that would enhance inclusive growth.

Ms Kristalina Georgieva, Managing Director, IMF, and Mr Olavo Correia, Cape Verde’s Finance Minister and Chair of the African Caucus in a joint statement after the meetings, said strengthening social protection is key to Africa’s development.

They also said leveraging digital infrastructure, such as mobile phone platforms, could help to increase efficiency and ensure social support was well targeted to the most vulnerable.

The group said in shock-prone environments such as Africa building resilience, including to climate change, remained fundamental.

“Mobilising additional external financing to support the recovery remains critical”, they said.

Georgieva said IMF was aware of the implications of external debt on the economy of African nations particularly the SSA countries would continue to provide technical assistance to them to mitigate the impact.

“The IMF continues to explore ways to make debt resolution more efficient. To this end, the IMF, together with the World Bank and the India G20 Presidency, have launched a Global Sovereign Debt Roundtable.

“The IMF remains steadfastly committed to the region and continues to work towards ensuring that its concessional lending toolkit for low-income countries is flexible, effective, and well-resourced.

“The Resilience and Sustainability Trust is now operational, providing longer-term affordable financing to address longer-term challenges, including climate change and pandemic preparedness.

“Rwanda is one of the first beneficiaries, with several other countries in the pipeline”, she said.

Nadia Calviño, the Chair of the International Monetary and Financial Committee said the meetings resolved enhanced commitment by members to ” coordinate our economic policies and to reinforce our global financial safety net.

“The meetings also resolved to work together in a constructive manner to deliver on our shared roadmap as we start the road to the Annual Meetings in Marrakesh.

The meetings have outlined and suggested pragmatic policies for the SSA region to cushion the effects of the global crisis as well as build external resilience and ensure sustainable growth.

Experts say the onus is on the governments and policymakers in the region to tailor these policies based on their peculiar challenges to steer the continent on the right economic trajectory.

They say it is also important for Bretton Woods Institutions to effectively implement resolutions at their meeting to stimulate economic growth and alleviate poverty in Sub-Saharan Africa countries.