Lagos, Oct. 26, 2023: Governor Babajide Sanwo-Olu of Lagos State has called for an integrated West African capital market to foster collaboration and tackle infrastructure gap.

Sanwo-Olu said this at the third West Africa Capital Market Conference (WACMaC) on Wednesday in Lagos, with the theme: “Infrastructural Deficit and Sustainbale Financing in an Integrated West African Capital Market.”

He said an integrated capital market in the sub-region would help to plug infrastructure deficits.

According to him, there are many ways that an integrated West Africa capital market can help with plugging infrastructure deficits in the sub-region.

“One is the Economies of Scale that will accrue from such an integration and this will enable the pooling of funds across the more extensive sub-region to finance large projects that can serve multitudes of people.

“In addition, an integrated capital market will result in the harmonisation of regulations to make it easier for trade and investments across borders and give confidence to investors,” he said.

The governor added that the ease of doing business that would result from a harmonised regulatory environment would open up funding possibilities for infrastructure projects in the sub-region.

He said that governments were actively aware of the imperatives of addressing infrastructure deficit and sustainable financing in the region.

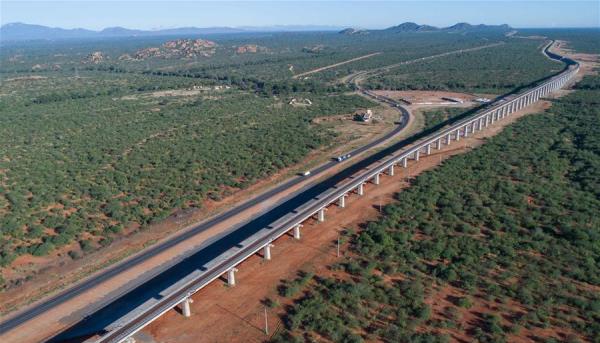

Sanwo-Olu said the theme of the conference was apt for the moment, as across the sub-region, modern infrastructure such as roads, rails, ports, fibre optics and connectivity power, among others, were largely inadequate.

“These perennial inadequacies have hindered the economic growth of our various nations and economic development of our people.

”It behoves, therefore, on us to deliberate on ideas, financial strategies that can bridge these infrastructural gaps, enhancing the quality of life of our people and propelling out economy to greater heights.

“While governments like ours continue to make efforts at plugging the huge infrastructural deficits, we cannot do it alone and that is why we are collaborating with you.

“We are waiting to see the types of innovative instruments and ideas that you can bring forward, for us to be able to do the quick and very difficult work that you have asked us to do.

“Only innovative and creative financing, especially the products coming out of the capital market that can ease this gap. I see you as strategic partners with us and indeed we can build that ecosystem that we all crave for.

“We believe there are many ways the West African capital market can help in this regard,” he said.

According to him, the West Africa Capital Market Integration (WACMI) Project, initiated in 2010, has progressively changed the landscape of the regional economy, fostering a harmonised regulatory environment for the issuance and trading of securities across the region.

He said this had been the bedrock of capital raising and securities trading across the sub-region.

Sanwo-Olu said the journey to an integrated capital market had been phased and complex, but the strides taken so far were worth celebrating.

“The Nigerian capital market has shown remarkable resilience and competitiveness, boasting a market capitalisation of $65.834 billion as of May 2023.

“This is not a mere statistics, but a testament to the inherent strength of our economy and the boundless potential that lies within our region.

“This forum serves as an opportune platform to promote integration, spur capital formation, accentuate tourism, and attract investors, thereby enriching our collective financial discourse and action.

“The recent appointment of His Excellency, Asiwaju Bola Ahmed Tinubu, as the Chairman of ECOWAS is further testament to the pivotal role Nigeria plays in the region.

“This new leadership role reinforces our commitment to driving the integration agenda and enhancing the economic prospects of West Africa.

“Hosting this prestigious conference in Lagos offers us a unique opportunity to showcase our economic mettle, our rich cultural heritage, and our warm hospitality,” he said.

Sanwo-Olu said the event would not only foster greater integration and capital formation but also stimulate tourism and attract even more investors to the region.

Also speaking, Sen. Osita Izunaso, the Chairman, Senate Committee on Capital Market and Institutions, said the infrastructure gap of ECOWAS economies varied.

Izunaso said the Nigerian infrastructure gap stood at $221 billion, while that of Côte d’Ivoire, stood at $14 million.

He said this showed that a lot had to be done to integrate the economy of the West African region, and that capital market remained the best option.

“It is important to state that there are challenges that we must look at if we truly believe that capital market has a role to play at the sub-region.

“The challenges are not so insurmountable; we have to look at regulatory and legislative impediments; we have to look at high transaction cost; multiple taxation; fragmented and small size of national stock market; capital and exchange control,” the chairman said.

Izunaso said these were the major challenges working against an integrated capital market in the sub-region.

He called for the harmonisation of disparities in legal and regualtory frameworks in the capital market, bridging the gap in capital market development.