The year 2018 was not so rosy for the Nigerian Stock Exchange (NSE) as its crucial indicators depreciated by 19.77 per cent due to uncertainties surrounding the forthcoming general elections.

The exchange which was named the third best performing stock exchange in the world in 2017 with over 43 per cent return-on-investment performed dismally in 2018.

Experts said the market, which started the first quarter on a positive note, nosedived due to the withdrawal of funds by foreign portfolio investors (FPIs) who were worried over the forthcoming elections.

A breakdown of the foreign investment outflow from the exchange between January and September 2018 showed that a total of N513.49 billion left the country during the period.

This amounted to 63 per cent increase in total outflow compared with N315.04 billion withdrawn in the same period in 2017.

Although both total foreign investment inflow and outflow increased month-on-month in September relative to the previous month, outflow grew at a higher speed, rising 27.6 per cent to N43.78 billion from N34.31 billion in August.

Foreign investment inflow, on the other hand, rose by 10.6 per cent to N40.54 billion from N36.7 billion in the previous month.

Investment experts, who attributed the sell-offs and the attendant foreign investment outflows to political risks, said the trend would be sustained throughout the election period.

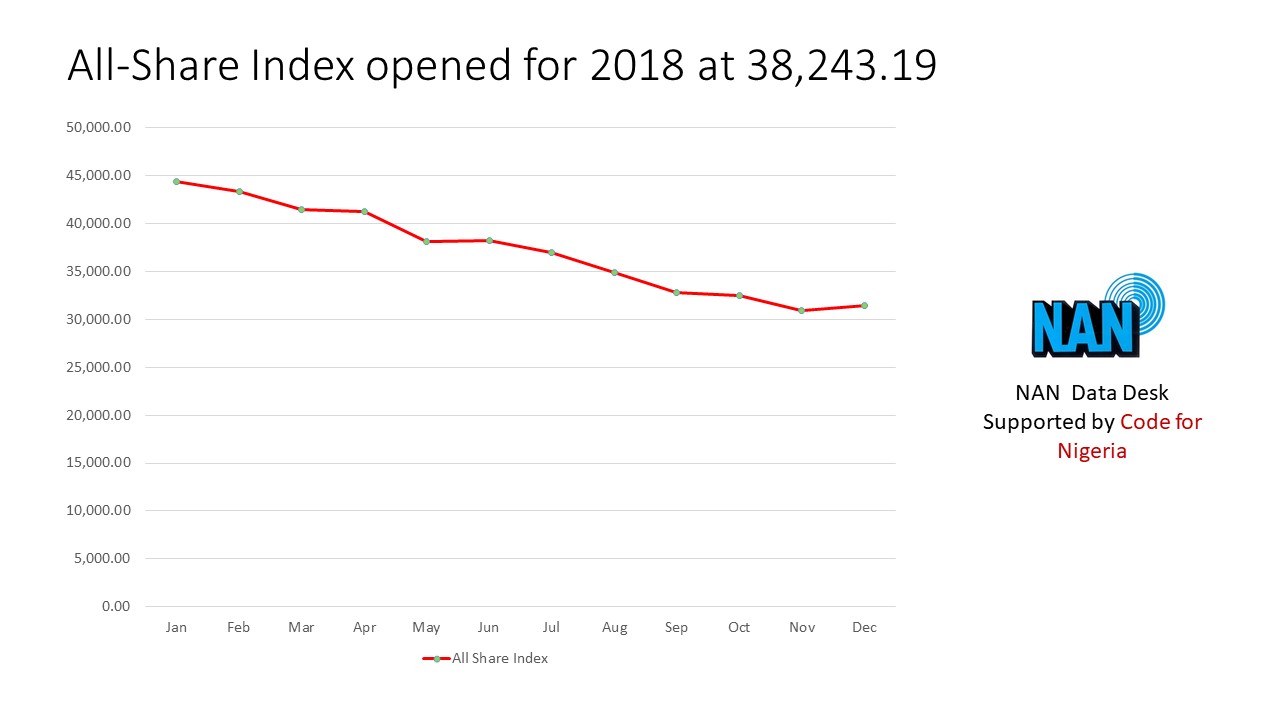

Specifically, the All-Share Index ,which opened trading in 2018 at 38, 243.19, shed 6, 812.69 points or 17.81 per cent to close at 31, 430.50, eroding over 43 per cent growth posted in 2017.

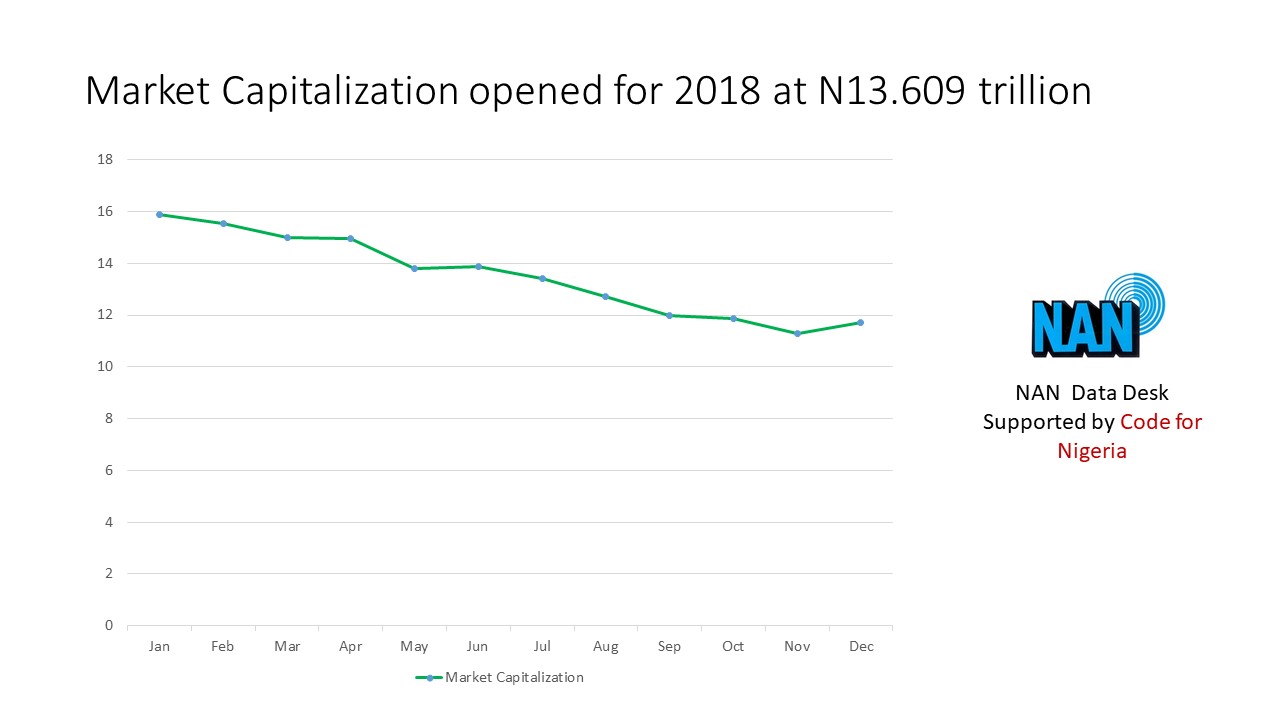

Similarly, the market capitalisation, which opened at N13.609 trillion, dipped by N1.89 trillion to close on Dec. 31, 2018 at N11.720 trillion.

Commenting on the performance of the market, Prof. Uche Uwaleke, head of Banking and Finance Department, Nasarawa State University Keffi, described 2018 as a very disappointing year for the equities’ market.

“With positive returns of over 40 per cent in 2017, Nigeria was ranked the third best performing stock market in the world after Argentina and Turkey.

“On the other hand, between January and December 2018, the market has plunged into a bear territory having lost over 20 per cent from its peak in January when it posted 16 per cent return.

“The dismal performance of the market has been in spite of improved corporate results announced by listed companies as well as stronger macroeconomic performance,” Uwaleke said.

He noted that the economy expanded faster in 2018, in terms of GDP by 1.95 per cent, 1.5 per cent and 1.8 per cent in the first,second and third quarters respectively, when compared with 0.8 per cent averaged in 2017.

“Again, the inflation rate is lower and the exchange rate has been stable on the back of stronger external reserves helped by higher oil prices and output relative to 2017.

“In the light of these, two major factors explain the weak performance of the market in 2018.

“The first is exogenous, the increasing yield environment in the US following the normalisation of interest rate by the US Federal Reserve. The second is the political tension ahead of next year’s general elections,” Uwaleke stated.

He highlighted the factors that would shape the performance of the stock market in 2019 to include the monetary policy stance of the US Federal Reserve, the extent to which the US-China trade tension and Brexit impacted global economic growth.

Others are: the ability of OPEC and its allies to keep oil prices high, political tension/outcome of the country’s elections, the fate of the 2019 budget and the direction of monetary policy in Nigeria.

On the way forward, he urged the Federal Government to defuse political tension and ensure free, fair and credible elections to boost investors’ confidence.

Uwaleke added that effective budget implementation would help create the right environment for both domestic and foreign investors.

Mr Sola Oni, a chartered stockbroker and Chief Executive Officer, Sofunix Investment and Communications, attributed the lacklustre performance of the capital market to illiquidity.

Oni said massive share dumping by nervous portfolio investors and their Nigerian counterparts who were apprehensive over the 2019 general election led to the trend.

He said the development was reinforced by unguarded utterances of the political class.

Oni said the factors that would shape the market in 2019 generally revolved around the weak global economy of which the exchange could not be insulated.

He explained that the outcome of the next elections and the ability to tackle the ongoing economic challenges, especially investment in infrastructure, management of fiscal and monetary policies, would shape stock market activities this year.

Mr Ambrose Omordion, the Chief Operating Officer, InvestData Ltd., described 2018 as a volatile and bearish year due to the interest rate hike, mixed corporate earnings and political uncertainties.

Omordion said peaceful conduct of the general elections, good economic reforms and diversification would drive economic activities in 2019.