By Tanko Mohammed

Grappling with a historical-huge national debt burden of $86 billion, inflation rate of 14.23 per cent, and a dip in national revenue by 60 percent, the Central Bank of Nigeria (CBN) has released a five-year policy plan to fast track the economy.

The plan is hinged on five major planks to salvage the world’s sixth largest oil producer and the biggest economy in Africa.

The World Bank puts Nigeria’s GDP at $397 billion, the highest in Africa and one of the world’s biggest oil exporters – and Africa’s biggest oil producer, pumping out a minimum of 2 million barrels daily.

But the economy is bogged by high inflation, crippling debt, and unemployment which cumulatively results in restiveness.

The Minister of State for Petroleum Resources, Mr Timipre Sylva, said on November 16, 2020 that the nation’s earnings, from oil and non-oil sectors coupled with low revenue receipts from the Federal Inland Revenue Service (FIRS) have dropped by 60 per cent, putting the nation’s economy under serious pressure.

“There is less activity in the oil industry which is driving the economy. So you find out it is a double whammy from all sides,” he briefed President Muhammadu Buhari.

The National Bureau of Statistics (NBS) also on November 16, 2020 presented an inflation rate of 14.23 per cent for the month of October, indicating a 14-month continuous increase in price levels.

The country had earlier taken some major decisions to spike the economy, including the ban on the importation of 43 items as a strategy to avoid the depletion of the foreign reserves of $36.57 billion which it says will sustain importation of essential goods for nine months.

The other is the retention of the exchange rate of N420 to a dollar to reduce the impact of continuous volatility in the exchange rate on the economy and stabilize the external debt.

Diversification of the economy which entails less dependence on revenue from oil and gas and to vigorously increase production, sustenance and export of non-oil based products, especially agriculture and food security.

The nation decided also to commit to a free trade regime that is mutually beneficial but not to subscribe to influx of goods which it seeks to improve to spur industrial growth and reduction of import.

Mr Godwin Emefiele, the Governor of CBN, has again presented an articulate five planks in the Monetary Policy roadmap for 2020 -2024, including deliberate plan to preserve domestic macroeconomic and financial stability.

The second leg is to foster the development of a robust payments system infrastructure that will increase access to finance for all Nigerians, thereby raising the financial inclusion rate in the country.

According to him, the third thing the bank hopes to achieve is to continue to work with the Deposit Money Banks to improve access to credit for not only smallholder farmers and Medium and Small Scale Enterprises (MSMEs) but also Consumer credit and mortgage facilities for bank customers.

Fourth on his list is to grow the nation’s external reserves, and lastly, support efforts at diversifying the economy through the various intervention programs in the agriculture and manufacturing sectors.

The bank launched a Trade Monitoring System, which is an automated system that will reduce the length of time required to process export documents from one week to a day.

“We will also work with our counterparts in the fiscal arm in supporting improved Foreign Direct Investment flows to various sectors such as agriculture, manufacturing, insurance and infrastructure,’’ the apex bank’s boss reported.

Aside helping to stabilise exchange rate and improve external reserves, he said the measures would support increase in inflows.

“In the next five years, we intend to pursue a programme of recapitalising the banking Industry so as to position Nigerian banks among the top 500 in the world.’’

Nigeria, has in the last three years, resorted to loans from the World Bank and Paris Club of creditors to bridge the deficit in its budgets, causing a spike in debt.

According to the National Bureau of Statistics (NBS) 34.89 percent of the total federal and state public debt is external while domestic accounts for 65.11 percent.

As the financial situation becomes more precarious due to the negative impact of coronavirus pandemic, the government has relieved itself of the burden of providing subsidy on petroleum products which has been having a toil on the yearly budget.

The Financial Operations report in March of the Nigerian National Petroleum Corporation (NNPC), shows that $1.06 billion was paid in subsidizing Premium Motor Spirit (PMS) in March 2019 and almost $2.1 billion in the first quarter of 2020.

President Muhammadu Buhari took the bull by the horns to effect the deregulation of the downstream sector which effectively edged out government’s subsidies.

According to Petroleum Products Pricing Regulatory Agency (PPPRA) the full deregulation of the downstream has led to the end of petrol subsidy and that petrol price would be adjusted in accordance to global oil prices.

But Mr Ayuba Wabba, the President of Nigerian Labour Congress (NLC), said:

“We are surprised that at a time other countries are giving palliatives to their citizens to cushion the effect of COVID-19, Nigerians are asked to pay more for petrol.

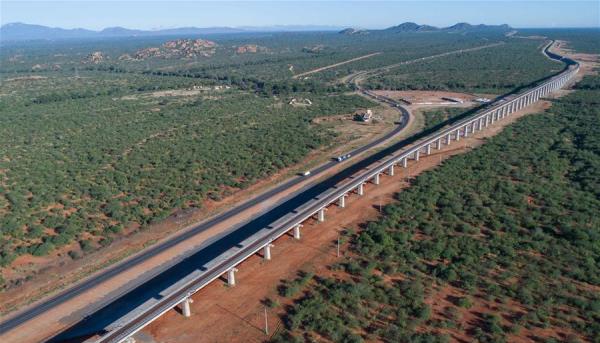

Information and Culture, Mr Lai Mohammed, reasoned that the huge debt is really not threatening, but explain that unlike in the past when the nation borrowed to “service the crass indulgence of a few fat cats”, the loans being obtained by the current administration were being primarily used to finance infrastructure – roads, railways, bridges and power.

He added that the loans also were long-term in nature, with little or no interest which would benefit present and future generations.

Also at a meeting with the Presidential Economic Advisory Council (PEAC), President Muhammadu Buhari on September 28, 2020 also justified the borrowing.

“We have so many challenges with infrastructure. We just have to take loans to do roads, rail and power, so that investors will find us attractive and come here to put their money.’’

Dr Timothy Olawale, the Director General of Nigeria Employers’ Consultative Association (NECA) expressed worry over the situation and said ““It is instructive to note that the persistent increase in food prices, caused by border closures, restrictions in FX market and insecurity predominantly in the Northern states has further heightened the situation.’’

“We urge, as a matter of urgency, that concerted efforts should be made across-board to create an environment that will not only attract foreign direct investment, but that will also enable current investors to remain sustainable as a way out of the challenges of a mono-foreign exchange economy, ” he said.

Also Mr Ayoola Olukanni, Director-General of Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA), has advised government to accelerate effective implementation of all stimulus packages and interventions funds to support the production processes of the real sector.

Olukanni said inflation, COVID-19 and recent protests against police brutality have contributed to the negative impact on production and consumption.

The NACCIMA DG said it had therefore become intuitive that attaining food security at this time would go a long way to stabilising general prices.

“If left unabated, the erosion of the purchasing power of the average Nigerian in an environment characterized by high unemployment rates and declining national output may plunge the country into an economic depression.

“We, once again, counsel government at all levels to accelerate the effective implementation of all stimulus packages and intervention funds, while also promoting the spending power of the average Nigerian,” he said.