The Federal Government is collaborating with Signature Advisory Limited, a real estate company, to explore the benefits of National Housing Bond to tackle the challenges of funding in housing financing in the country.

The plan to explore the National Housing Bond was unfolded on Tuesday in Abuja when the Federal Ministry of Works and Housing (FMWH) and the Signature Advisory co-hosted the Housing Investment Forum.

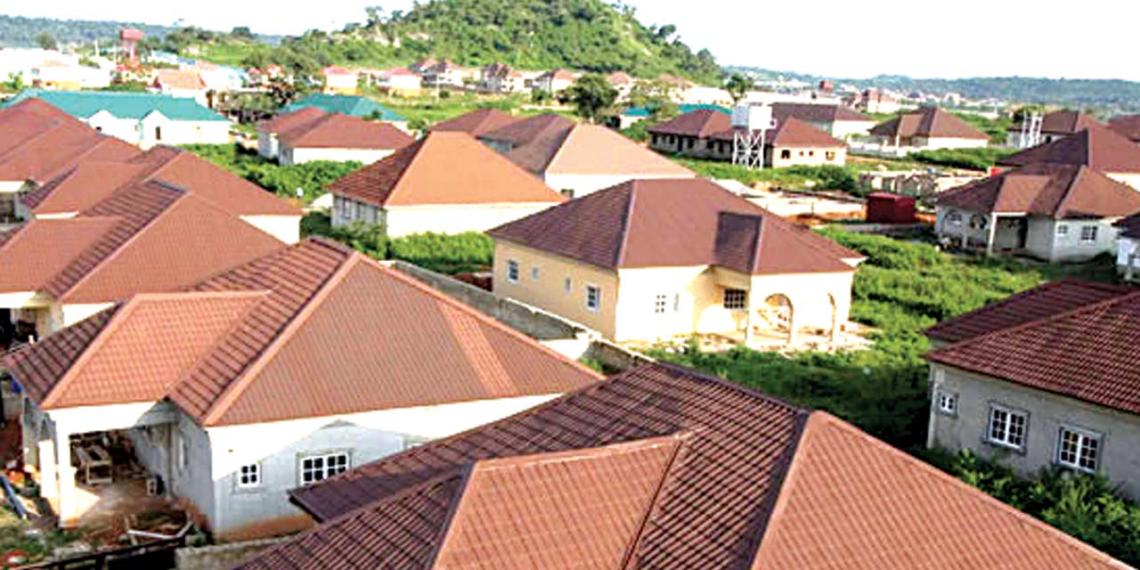

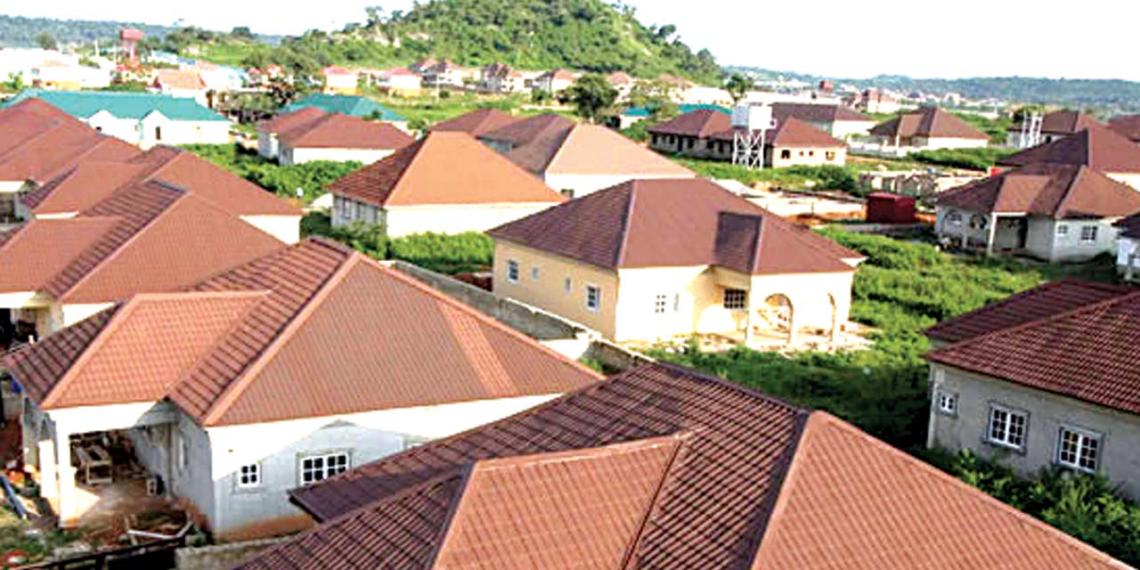

The objective of the forum is to explore the option of floating a national housing bond, proceeds of which will be made available to private sector housing developers across the geographical zones.

This is expected to provide the much needed funding that has been available to developers and expand the housing infrastracture in the country thereby improving the quality of life of citizens.

In his Keynote address at the forum, the Minister of Works and Housing, Mr Babatunde Fashola, gave credit to Signature Advisory Limited for the initiative for lashing on statements he had made on the need to improve housing financing.

”Government as an enabler could visit the redeployment of her fiscal and monetary policy tools in order to unlock the financing side of the housing sector.

“I am happy to see a few things, a very rapid emergence of the private sector players in the housing supply setup in last five or so years.

“it’s something as a government we must want to multiply, you must want to improve upon in terms of its quality and reliability.

“We want this to become sustainable for the future of housings, where responsible players will do what they say they can do.

“It is important that government keeps the line of communication open and invigorated. It may be a bond it may be real estate investment trust, it may be the reform and the national housing fund itself.

“It may be fast credit scheme for housing, it may be a sukuk and it may be none of them and it may be all of them whatever it is, I hope it is innovative,” he said.

Fashola said whichever it was he hoped that it was workable, accessible and sustainable to finance not only the construction of houses but also to acquire them.

“And create the real housing economy of Nigeria, building the housing economy that influences everybody from top to bottom and create a sustainable career path and investment part that people can plan their lives around.

“We will take all the recommendations that will come out of this meeting and seek to give life to it,” Fashola said.

On his part, Mr Samson Davies, Managing Director of Signature Advisory Limited, said over the years Nigeria had witnessed significant growth in its Gross Domestic Product with the service sector comprising the real estate industry contributing significantly.

He said the collaboration with the ministry would support the existing efforts of private real estate players in Nigeria and eventually open a flood gate of affordable funding for mass housing development.

Davies concluded by saying that the forum would explore modalities and feasibilities of a possible Public Private Partnership for housing development through the National Housing Bond, proposed to be raised in the Nigerian Capital Market.

The Director-General Securities and Exchange Commission, Mr Lamido Yuguda, speaking on the role of his commission in the process said housing affordability remained a challenge.

Yuguda said to mitigate the funding gap in the housing sector, Primary Mortgage Institutions had seen the Nigerian Capital Market as a viable channel for accessing affordable long term funding at a relatively low rate.

“Hence the need for collaboration with registered capital market operators to bridge this identified gap,” he said.

He was represented at the forum by Mr Temidayo Obisan, Executive Commissioner Operations, Securities and Exchange Commission.

Also speaking at the event the Director-General, Debt Management Office, Mrs Patience Oniha, recommended that there must be improvement on existing structures and processes to increase efficiency and improve access to funding.

Oniha said this could be done when the private sector developers raised funding in their homes, supported by guarantees with proper risk management frameworks and controls in place.

Also strict monitoring to ensure delivery and repayment of the bonds and amendment of laws to enable foreclosure and establish dedicated commercial court.